COM. CHANDRAMOULI ELECTED JOINT SECRETARY TO THE ALL INDIA PUBLIC SECTOR AND GOVERNMENT OFFICERS CONFEDERATION:

The All India Public Sector and Government Officers Confederation had its All India Convention at Chennai on 05.08.2017.

On behalf of AIACEGEO, Com. R. Chandramouli participated. The proceedings were web cast live.

Com. Chandramouli has been elected as the Joint Secretary of the forum.

We assure Com. Chandramouli all our support, while he takes up a larger role in a larger platform for the betterment of a larger community.

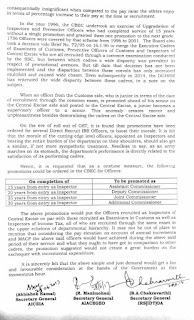

The Office bearers are:

All India Public Sector and Central Govt Officers Confederation

President

V.K. Tomar – Telecom 9868133336 vinodtomar63@gmail.com

Secretary General

D.T. Franco – Banking 9445000806 ngcfranco@gmail.com

Treasurer

T. Senthi Kumar –Banking 9445000838 senthi.kt@gmail.com

Vice Presidents

S. Mohan – CCGGOO 9445040751 smohan_1958@yahoo.co.in

Sebastian – Telecom 9868266200 ksebastin@gmail.com

Alok Roy – Oil 9999097956 alokroy20@gmail.com

Sanjib Kumar – Railway 9777442335 kumarsanjib59@gmail.com

Dushyant Chavan –NABARD 9176876101 dush_chn@yahoo.com

Dilip Kumar Saha – Banking 9820300338 aipnboa@yahoo.com

Joint Secretaries

H.M. Mallesh – Defence 9482941144 hmmtaru@yahoo.co.in

D. Subramani- Pharma – KAPL 9448018407 smani_doraiswamy@yahoo.co.in

Raj Kumar – LIC 8589819933 s.rajkumar@licindia.com

R. Chandramouli – GST & Central Excise – 8939955463 spiel1106@gmail.com

Anil Gupta – ITDC 9560197433

G Anil Kumar – ITI – NCOA 9447345772 anilgeeiti@gmail.com

Ms. Geeta Sunatkari- Mazogon Dock- 9869056540 gsunatkari@mazdock.com

Dy. General Secretary

Lakshmi Narayana – NCOA – smln186@hotmail.com

Ashok. M. Shethalke - Mazogon Dock 9820732120- ashokhalkar@mazdock.com

The report of the said Convention is reproduced below:

*Public sector, Central Govt officers to launch agitation against 'privatisation moves'*

August 6, 2017 by VINSON KURIAN

The Officer cadre in the public/ Central Government sectors is growing restive over ‘suspected moves’ aimed at large-scale mergers/ privatisation.

The All India Public Sector And Central Government Officers' Confederation has decided to launch a nationwide agitation programme until such ‘ill-conceived moves’ are called off.

REPRESENTATIVE SECTORS

These programmes would include nationwide demonstrations and a march to Parliament, in line with decisions taken by the first Conference of the Confederation held in Chennai on Sunday.

The Confederation claims to represent 13 lakh officers drawn from the banking, oil & gas, telecom, defence, railways and pharma sectors; GST & central excise; LIC and insurance; and Central public works, among others.

Representatives of various unions from these sectors shared their concerns on the ‘retrograde moves to privatise’ public sector undertakings and enterprises, a spokesman told BusinessLine.

The representatives also appraised the delegates on how the ‘faulty policies of the successive Governments’ has ensured the systematic weakening of the public sector.

SHIFTING BURDEN

Rather than making persons responsible for their mismanagement, the burden is now sought to be shifted to employees.

A public perception is sought to be created using mainly the electronic media in favour of privatisation.

The Conference unanimously opposed "the road map laid at the behest of NITI Aayog, Banks Board Bureau and the RBI to weaken and privatise public sector organisations."

It resolved to oppose what it described as anti-labour and anti-people moves and agitate and fight together whenever any sector or an enterprise is under attack.

The Confederation will not accept the argument of "affordability" put forward by the Government for pay revision, the spokesman said.

It resolved to demand a common forum of public sector undertakings/ enterprises to represent and settle with the Government for a uniform pay revision and other benefits.

*GRIEVANCE REDRESSAL*

The Conference also demanded that there should be grievance redressal mechanism for Gazetted officers of the Central Government, the spokesman said.

The Confederation proposes to reach out to the public through its programme called ‘Peoples Parliament for Unity and Development’ to know what sort of growth they require and will pledge to them its support in each district of the country.

Awareness will be created amongst the public about the contribution of the public sector in the development of the nation since Independence and its requirement for inclusive growth.

The Government has always understated the efforts put in by the public sector and its employees to successfully carry out its various social security schemes.

*Courtesy : The Hindu Business line*