For clarity the word document of the memorandum is reproduced below:

| ALL INDIA ASSOCIATION OF CENTRAL EXCISE GAZETTED EXECUTIVE OFFICERS (Representing the Superintendents of C.Ex & CGST) [Recognised vide CBEC Letter F. No. B 12017/10/2012-Ad IV A dated 25/02/2013] 6/7 A.T.D. Street, Race Course Road, Coimbatore – 641018. | |

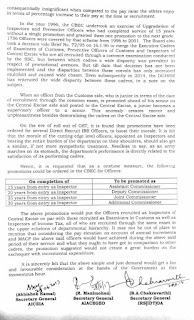

| President Sanjay Srinivasan Vice Presidents: Prabir Mukhopadhyay Sanjay Kumar H.S. Bajaj K.S. Kumar P.K. Jaishankar Iyer Secretary General R. Manimohan (09443063989) Asst Secy General Shishir Agnihotri Joint Secretaries: Kousik Roy D. S. Thakur Malkit Singh Kalugasala Moorthy Sandip Panvalkar Core Committee: Tirthankar Pyne Ajit Kumar K.G. | Ref. No: JAC/01/17 Date: 30.06.2017 MEMORANDUM TO THE HON’BLE FINANCE MINISTER Respected sir, tonight, when half the world sleeps, India would be waking up to a new era of GST. When all buildings of the Tax department are illuminated for the grand event, the real shoulders on which the entire edifice rests, would be weeping in the dark gullies, just like the Father of the Nation on that eventful night 70 years ago. The anguish of this community recruited as Inspectors of Central Excise, is narrated in the Memorandum -1 dated 28.06.2017 submitted by the ‘JAC of Inspector based Associations of CBEC’, copy of which is enclosed. The first table in the memorandum will demonstrate the discrimination this community has faced. As if that discrimination in comparison to the other cadres and equivalent cadres within the department and within the Revenue is not enough and complete, a fresh one has come into being in terms of their further degradation in comparison to their counterparts in the State VAT departments. In most of the States the counterparts to the Superintendent of Central Excise have attained the level of Deputy/ Joint Commissioners. In the era of cross empowerment, this comparison would rub salt into their already burning wounds. In the unsuspecting public sphere of the taxpayers it will also malign the position of the Union Government, vis-à-vis the State Governments. A recent letter of Sh. Netticadan Antonio, Superintendent of Central Excise addressed to his Chief Commissioner, Thiruvanandhapuram, intimating withdrawal from an expert panel on GST, at a high profile function to be presided over by none other than the Finance Minister of the State, is indicative of the two sides of a coin. One, the dark deep frustration engraved in the heart of this community; and two, despite such frustration, their sense of service and commitment towards excellence. (Copy of the letter and the invitation card for the event are enclosed for reference). We urge you to step in not only to stem the rot but also to resolve this absolute despondency and growing resentment at the cutting edge level Officers of the department, and put in place a proper and time bound promotion mechanism as set out in the JAC memorandum. Yours truly, Encl : As above (R. Manimohan) Secretary General Copy submitted to: (1) The Revenue Secretary 2) The Chairman, CBEC |